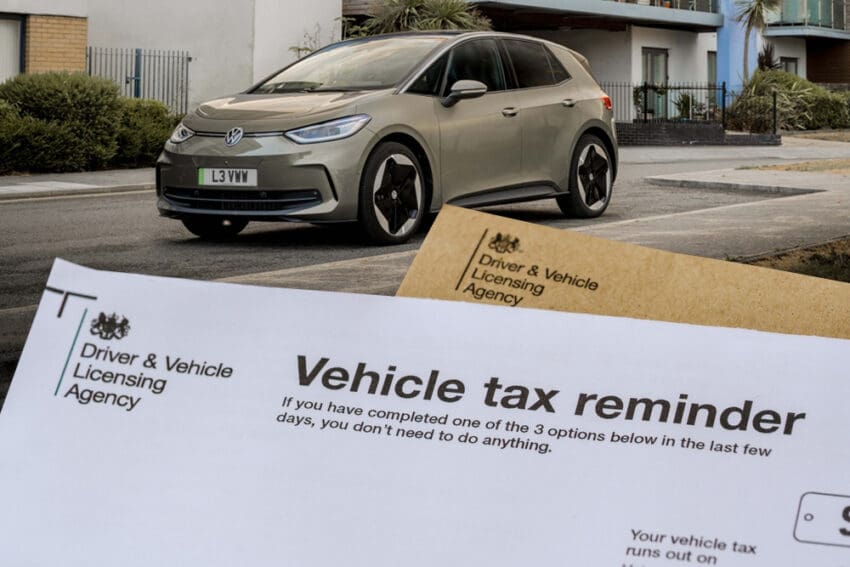

Starting April 1, 2025, electric vehicle (EV) owners in the UK will face a major tax overhaul as the government implements new Vehicle Excise Duty (VED) regulations. This change, aimed at addressing lost revenue from declining fuel duties, will see EVs taxed similarly to petrol and diesel vehicles.

New Tax Rules for Electric Vehicles

For the first time, EVs will no longer enjoy complete road tax exemptions. Instead, the following VED charges will apply:

- First-Year Tax: New zero-emission vehicles registered from April 1, 2025, will be subject to a first-year VED of £10.

- Annual Standard Rate: From the second year onward, EVs will be taxed at the same standard rate as petrol and diesel cars, set at £195 per year.

- Expensive Car Supplement: EVs with a list price exceeding £40,000 will incur an additional charge of £425 per year for five years, starting from the second year of registration. This amounts to an extra £2,125 in tax over the period.

These changes align EV taxation with traditional internal combustion engine (ICE) vehicles and aim to generate additional revenue as more drivers shift to electric mobility.

Impact on EV Owners

The new tax regulations will have a significant financial impact on many EV owners, especially those purchasing premium electric models. Many popular EVs, such as the Tesla Model Y, Volkswagen ID.3, and Kia Niro EV, have base prices above £40,000, making them subject to the Expensive Car Supplement.

Previously, one of the main financial incentives for EV adoption was the lack of road tax. With this exemption removed, buyers will need to reconsider their total cost of ownership.

Rationale Behind the Tax Change

The UK government justifies these changes as a necessary measure to compensate for the declining fuel duty revenue. As more drivers switch to electric cars, the traditional tax system based on fuel consumption becomes less effective in funding road infrastructure and public transport projects.

According to the UK Treasury, fuel duty revenue has steadily declined as EV adoption has accelerated. By introducing VED for EVs, the government seeks to create a more sustainable tax framework while still encouraging low-emission transportation.

For more details on VED rates, visit the official UK Government website.

Potential Effects on EV Adoption

Industry experts and environmental groups have raised concerns that the new tax changes could slow down the UK’s progress toward net-zero emissions. The UK has set ambitious targets to phase out petrol and diesel car sales by 2035, but additional costs on EV ownership may deter some potential buyers.

“The removal of tax incentives could lead to a slowdown in EV sales,” said a spokesperson for the Society of Motor Manufacturers and Traders (SMMT). “We need continued financial support to encourage consumers to make the switch.”

Despite this, the government argues that other EV incentives, such as lower running costs, congestion charge exemptions, and grants for home charging stations, will continue to make electric cars an attractive choice.

Should You Buy an EV Before April 2025?

Prospective EV buyers may want to finalize their purchase before April 1, 2025, to avoid the additional road tax. Vehicles registered before this date will not be subject to the new VED rates, allowing owners to enjoy tax-free status for the remainder of the vehicle’s lifespan.

This means purchasing an EV before the deadline could lead to significant savings, especially for those considering high-end models that would otherwise incur the Expensive Car Supplement.

To explore the latest EV models and incentives, visit the UK Government’s Plug-in Grant Scheme page.

Looking Ahead

While the introduction of VED for EVs may seem like a setback for electric mobility, it reflects a shift towards a more balanced tax system as the UK moves toward an all-electric future. The road tax overhaul is a reminder that while EVs offer numerous advantages, financial considerations will continue to evolve alongside government policies.

For further details on how these changes may affect you, visit the official VED guidelines.

Vikas is a seasoned finance writer with a keen eye for unraveling complex global financial systems. From government benefits to energy rebates and recruitment trends, he empowers readers with actionable insights and clarity. When he’s not crafting impactful articles, you can find him sharing her expertise on Social Media. You can connect with him via email at [email protected].